Tax governance framework

Tax governance continues to attract the ATO’s attention. Privately-owned groups are significant contributors to the Australian economy and governance frameworks are regularly assessed to provide assurance that privately-owned groups are satisfying their tax obligations.

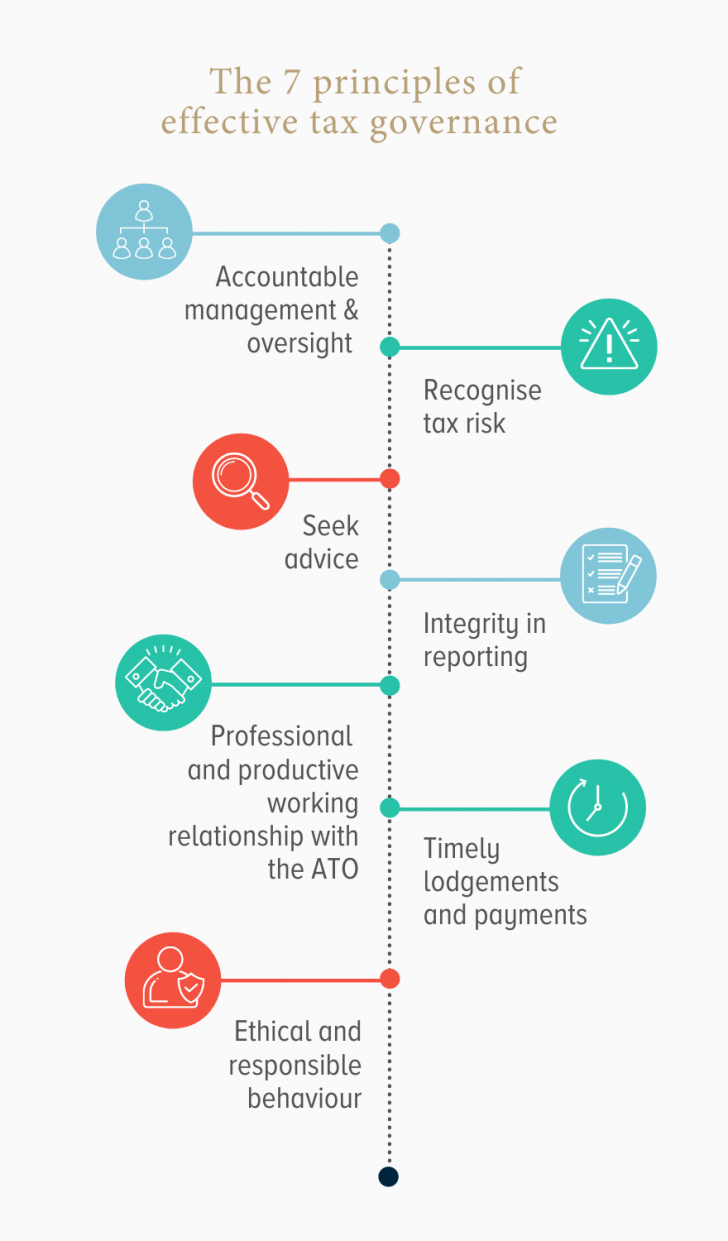

Developing an effective tax governance framework amongst privately owned groups should be bespoke as each group is unique. Nevertheless, whilst each business may have a different size, complexity, history or culture, the ATO makes clear that each group should, at the very least, incorporate the same principles of effective tax governance. The principles of effective tax governance include, but are not limited to, recognising tax risk, seeking advice and acting ethically and responsibly. Ensuring that your tax governance framework maintains these principles is key to influencing your tax profile with the ATO.

To assist our clients in meeting the ATO's requirements, we have provided a high-level overview of why a comprehensive tax governance framework is necessary, what the ATO is looking for when assessing a tax governance framework and, the key elements that a tax governance framework should include.

Effective tax governance frameworks

Effective tax governance frameworks identify, assess and manage tax risks. Any framework that is established must also recognise the differences between the internal tax mechanisms of the taxpayer and its business lines, and the tax mechanisms required on an ‘asset’ or ‘investment’ level.

The benefits of a framework:

- Promote accountability, transparency and compliance

- Maintain and generate confidence for the taxpayer that its tax obligations are being appropriately met

- Assure the ATO that the taxpayer’s tax affairs are under control, and

- Reduces compliance costs.

The costs without a framework:

- Increased and more aggressive audit activity for the principals and their businesses

- May limit the opportunities available to the private group regarding future transactions at an entity or asset level, and

- Increased risk of participating in aggressive tax avoidance strategies with the potential to destroy family wealth in the long term.

Why have a tax governance framework?

Promote accountability and transparency

- Manage tax risks appropriately

- Support investment, financial and operating decisions, and

- Reduce the chances the ATO conducts a thorough audit.

Ensure compliance

- Meet regulatory and legal obligations

- Provide real-time assurance to optimise business lines and transactions, and

- generate accurate financial reporting.

Maintain and build stakeholder confidence

- Maintain confidence in company strategy and management

- Maintain confidence in risk management, and

- Avoid any inference of fraud or unethical dealing.

Clean Exit

Implementing a tax governance framework will:

- Promote potential purchaser confidence in the event of a shareholder exit or IPO

- Protect and foster business growth, and

- Remove any skeletons in the closet.

Cost of doing nothing

- Unknown and unplanned tax liabilities

- Penalties and interest

- Reputational damage

- Reduction in shareholder value

- Directors’ and Officers’ liabilities, and

- Increased ATO attention.

What does the ATO look for?

The ATO looks for comprehensive tax governance frameworks that are designed to go beyond tax technical risks.

Specifically, the ATO looks at:

- Documented policies, decision-making processes and tax control frameworks

- Adoption of the ATO Tax Management & Governance Review Guide principles

- Internal and external testing of controls

- Distribution of responsibilities between the Board and Management

- Appropriately defined and understood roles and responsibilities

- Use of qualified professionals to provide proper advice

- Tax liability and cashflow management

- Adoption of the ATO’s Tax Transparency Code

- Use of ‘the 3 lines of defence’:

- Board committees and independent assurance providers

- Management, and

- Internal compliance functions.

What are the key areas?

There are three key areas that should be incorporated into any tax governance framework:

Tax strategy

A successful tax strategy will have the following characteristics:

- Reflective of the taxpayer’s culture

- Align the tax strategy and objectives with the overall strategies and goals of the organisation

- Ensure that the tax strategy is comprehensive and provides for full realisation of any and all potential tax obligations, and

- Ensure that tax positions are aligned with commercial objectives, consistent with risk appetite and are reasonably arguable.

Risk policy

Any risk policy implemented should:

- Be consistent with the taxpayer’s broader risk profile

- Define, assess and review the organisation’s overall appetite for tax risk

- Be regularly reviewed, and

- Applied on an ongoing basis.

Tax control framework

Tax control framework should be considered on two levels:

Strategic level

- Identify tax opportunities and integrate with the overall governance framework, and

- Ensure appropriate board and committee oversight.

Operational level

- Manage tax risks, internal controls and tax processes, and

- Ensure defined roles and responsibilities are adhered to.

What steps are involved?

The development of a tax governance framework should be broken down into three steps: Identify, Assess & report and, Manage. We've outlined some of the key considerations that you should be aware of at each stage below.

Step 1: Identify

- Actual or perceived risks.

- At a transaction level - pre-deal, during the deal, and post-deal.

- Multi-stakeholder contribution e.g. investment manager contributions, JV Partners.

- Remain vigilant.

- Key personnel understand the risk policy and understand they are also responsible for identifying tax risks.

Step 2: Assess & report

- Create and maintain a risk register.

- Assess risks for their materiality and potential cost to the taxpayer.

- Escalate assessments internally and seek external advice consistent with the principles of the risk policies.

- Document assessments and reports.

Step 3: Manage

- Manage risks consistently with the tax strategy.

- Allocate the right resources, maintain relationships with tax authorities.

- Review consequences and the effect on tax planning.

- Assign the best method of treatment (avoid, accept, reduce, transfer).

- Maintain a record e.g. opinions obtained, correspondence with the ATO.

Justified Trust

Tax governance is a fundamental pillar of 'justified trust' reviews. The ATO’s one-on-one approach seeks to understand the operational effectiveness of tax governance arrangements within the context of the taxpayer’s business (i.e. a tailored approach).

- Good tax governance for a particular business will depend on its size, complexity, history and culture.

- Broadly, the ATO will review the following aspects of tax governance:

- the key roles and responsibilities related to recognising and managing tax risks

- the processes and controls in the preparation of the taxpayer’s income tax return process

- how the tax governance controls are tested to ensure compliance with tax and superannuation laws.

- The ATO will expect tax governance documents to have been prepared and readily available. However, tax governance can be undocumented.

ATO focus areas

There are six ATO focus areas for tax governance of privately owned groups: Roles and

responsibilities, Control framework, Control testing, Risks flagged to market, Significant or new transactions, and Tax and accounting results.

Areas that should be addressed by tax risk management framework

Control framework

- Formalisation of tax strategy, controls and processes.

- Effective control processes to identify and manage tax risks (i.e. IT or manual controls).

- Escalation procedure for tax risks.

Control testing

- Audit and/or review plan for tax functions.

- Document retention practice (i.e. working papers, tax reconciliations etc).

Significant or new transactions

- Tax identification and review processes to assess the tax implications of significant transactions to manage tax and commercial risks.

Tax and accounting results

- Preparation of tax risk registers and escalation documentation.

- Integrity of accounting data and financial statements.

- Appropriate accounting reconciliations.

Risks flagged to market (should be addressed by both tax governance framework and board policy)

- Consideration of available ATO guidance that may be applicable to the taxpayer’s business (i.e. taxpayer alerts, ATOIDs etc).

- Early engagement procedures where potential ATO disputes may arise due to differing interpretations of the law.

Areas that should be addressed by board policy

Roles and responsibilities

- Documentation of tax roles and responsibilities for individuals within the group.

- Chain of command for tax sign-off and administration.

- Whether those charged with governance understand their tax and superannuation obligations (i.e. reporting and filing requirements).

Risks flagged to market (should be addressed by both tax governance framework and board policy)

- Consideration of available ATO guidance that may be applicable to the taxpayer’s business (i.e. taxpayer alerts, ATOIDs etc).

- Early engagement procedures where potential ATO disputes may arise due to differing interpretations of the law.

Example of tax governance framework structure

Your tax risk management framework must be bespoke and specific to your business. This will ensure it is effective, ATO compliant and achieves ‘justified trust’.

Following a discussion on key high-level tax governance considerations and opportunities for your business, we will assist by drafting a tailored tax risk management framework that meets your needs.

While each tax risk management framework is unique, we have set out a sample structure to the right.

Contact our tax team

Arnold Bloch Leibler is the tax controversy sector leader in end-to-end management of taxation disputes and litigation arising from ATO compliance activities and audits. If you would like to discuss the implementation of a Tax Governance Framework for your group, please contact one of our team members below.