Individuals & groups who fall within this program

The Top 500 include private groups that are not public groups or foreign owned which:

- have over $250 million in turnover, regardless of asset value

- have over $500 million in net assets, regardless of turnover

- have over $100 million in turnover and over $250 million in net assets

- are market leaders or of specific interest.

FAQs about the Top 500 program

What does the Top 500 program look like?

The Top 500 program is an extension of the ATO’s previous Top 320 program and involves tailored one-to-one engagements. It is likely most private groups that participated in the Top 320 program will be reviewed by the ATO under the Top 500 program.

The Top 500 program adopts an approach of one-on-one, open and transparent engagement, where each Top 500 group is provided with the opportunity to demonstrate that they have been paying and will continue to pay, the correct amount of tax.

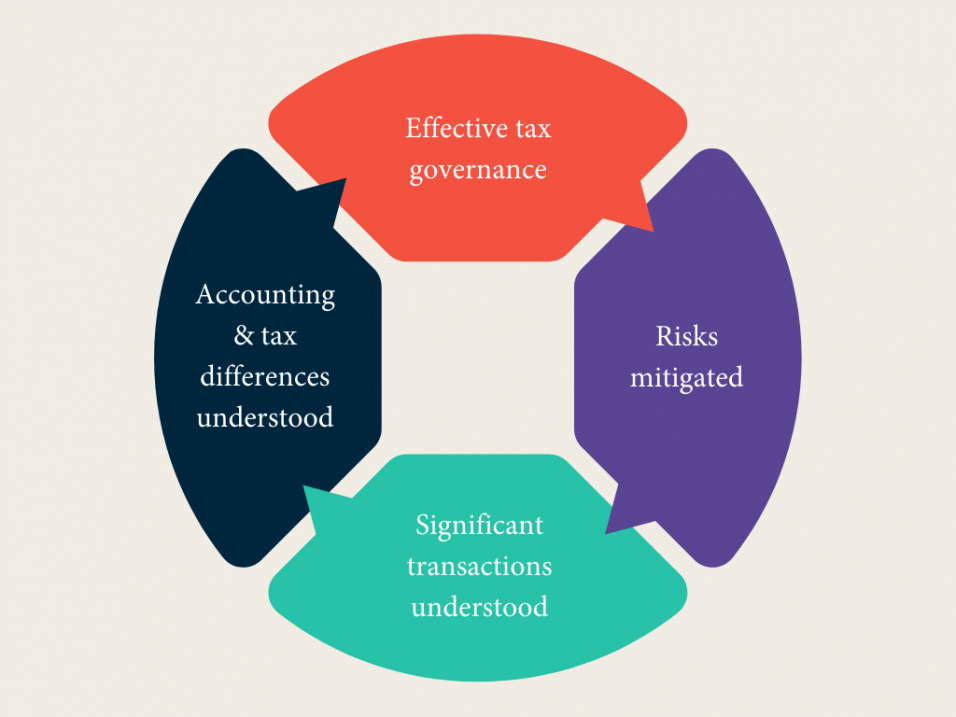

The Top 500 program is underpinned by the concept of ‘justified trust’, which is based on four key areas; the effectiveness of tax governance, tax risks flagged to the market, significant and new transactions and why accounting and tax results may vary. Justified Trust is a concept from the OECD that lays the foundations for effective tax governance. It is intended to be a ‘lighter touch’ approach to compliance than lengthy annual risk reviews by the Tax Office.

Based on the ATO’s interactions, groups will be placed in one of the following engagement experiences:

- Partner (high-levels of assurance) – the ATO partners with the group to maintain good compliance. The ATO has confidence that all entities within the group have paid the correct amount of tax in the years the subject of the assurance review, and will continue to pay the correct amount of tax.

- Encourage (partial assurance) – the ATO encourages the group to address identified concerns. The ATO has confidence that specific entities within the group paid the correct amount of tax in the years subject of the assurance review. Partial assurance does not necessarily equate to the identification of a specific mistreatment.

- Influence (no or low assurance) – the ATO takes action to improve the group's compliance. The ATO usually has little or no confidence that any entity within the group has paid the correct amount of tax in the years subject of the assurance review. This usually encompasses the identification of a specific mistreatment of a tax issue.

A Top 500 private group in the 'Partner' category will benefit from a maximum of three years of monitoring and maintenance. During this three-year period, the ATO will only seek to verify significant new transactions that may have occurred and discuss any other material changes to the group. Groups in the 'encourage' and 'influence' categories can expect a higher level of interaction. This may include comprehensive reviews and audits where tax risks remain unresolved.

The ATO recently released its interim findings report in relation to its Top 500 private groups tax performance program. The ATO report identified low levels of tax governance as the main reason why only 10% of Top 500 groups have achieved "Justified Trust" status with the ATO. In particular, the ATO has observed a reluctance among many groups to meaningfully invest in tax governance, particularly over the numerous tax issues that arise in the process of wealth extraction.

What is the purpose of the Top 500 program?

The program allows the ATO to obtain a holistic picture of the Top 500 group’s business/transactional/income producing activities (including how wealth is extracted) and to evaluate whether the group’s tax governance is effective.

According to the ATO, the Top 500 program seeks to give the community confidence that Australia’s largest private groups and high wealth individuals are paying the right amount of tax. The program aims to increase willing participation, focusing on prevention rather than correction. In doing so, the program provides the ATO with defensible data about the level of engagement with the tax system among Australia’s largest privately owned groups.

Where a Top 500 private group does not wish to engage with the ATO in an open and transparent manner, the ATO may engage in a traditional review and audit.

How the ATO applies the justified trust methodology to Top 500 reviews?

To achieve justified trust across a Top 500 private group the four key areas need to be met at a ‘whole of group’ level:

- Effective tax governance frameworks, process and procedures are in place.

- Risks flagged to market in the ATO’s Taxpayer Alert and Ruling programs are not present in the group.

- The tax treatments applied to tax issues arising from ordinary and atypical transactions are demonstrated as correct.

- Differences in accounting and tax results are complete and understood in context.

What is the timeframe for a review?

The Top 500 assurance engagements are approximately 12 months in duration and take a holistic approach to the question.

Top 500 private groups should expect their engagements with the ATO to cover all tax and superannuation obligations, including income tax, GST and excise. As discussed under “What does the Top 500 program look like?”, a Top 500 group that has obtained justified trust will benefit from a maximum of three years of monitoring and maintenance. All other groups can expect ongoing and constant monitoring.

At the end of engagement for a specific year, the ATO will:

- outline the events and transactions where they agree with the tax treatment adopted and have tax assured

- give specific feedback based on what they have observed during the engagement. This feedback may highlight areas for improvement and provide guidance on what you can do to mitigate risks in the future

- outline the risks they are not satisfied with and the next steps they intend to take.

What should you do?

Private groups within the Top 500 program should engage with their accountants and legal advisers to undertake the following preparatory activities:

- Review their tax governance framework including the roles and responsibilities of board management, tax and financial personnel (including internal audit) and external advisers, as well as control systems and testing.

- If there is no formally documented tax risk management and governance framework, then ensure one is implemented.

- Ensure that all contemporaneous documentation and advice has been retained and collated that supports the tax treatment of your significant or new transactions.

- Prepare or update group structure diagrams and organisational charts.

- Collate all trust deeds, trustee distribution resolutions, company constitutions and other constituent documents.

- Collate financial accounts/materials, tax and accounting reconciliations and real property records.

- Review any recent significant transactions, related party transactions and restructures.

- Consider whether there is a requirement to complete a reportable tax position schedule.

The risk of not preparing properly is that you will not be in a position to provide the ATO with the requisite assurance to place you into the low risk category. This could result in the review transitioning to an audit and becoming a costly and drawn out process.

What is attracting the Commissioner’s attention?

General concerns

- Wealth extraction (Division 7A, misuse of SMSFs).

- Inter-generational family wealth transfers, or the transfer of control of businesses from one generation to another, including partial and complete business exits.

- Poor tax governance and record-keeping.

- Low transparency of tax affairs and aggressive tax planning.

- International movements of money, IP rights and foreign assets, repatriation of assets to Australia, and tax residency. This is particularly significant given the ATO’s international reach through tax treaties and information sharing agreements.

Specific concerns

- Inappropriate access to concessions (Division 40, R&D).

- Capital v revenue (property development and construction industries).

- Business v Hobby (Equine, Aviation, Marine).

- CGT (Internal restructures, atypical transactions).

- Transfer pricing.

- Section 100A.

- Section 99B.

Contact our tax team

Arnold Bloch Leibler is the tax controversy sector leader in end-to-end management of taxation disputes and litigation arising from ATO compliance activities and audits.

If you have identified issues or would like assistance in reviewing risks or uncertainties, please contact one of our team members below.