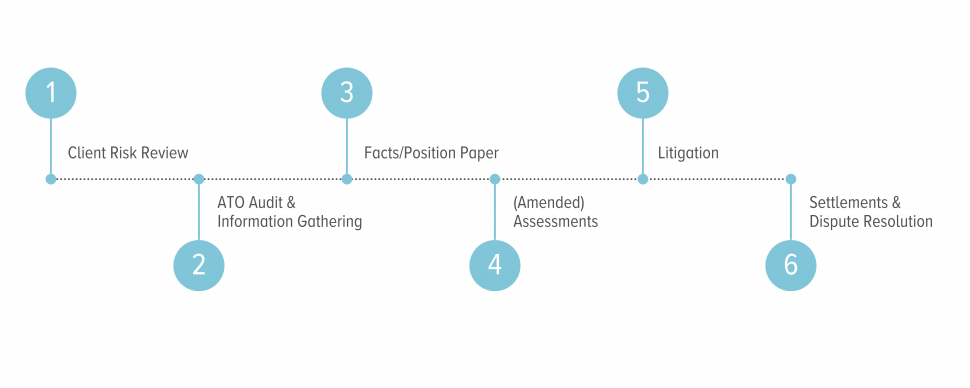

The six stages of a tax dispute

When a public group or multinational enterprise (MNE) is audited or reviewed by the ATO, this is rarely an enjoyable experience for those working within the organisation’s internal tax department.

Under Australia’s self-assessment tax system, effective risk management is critical. Risk management ought to start before the commencement of a review or audit, but that is not always possible.

The team at ABL is highly experienced at advising taxpayers who are undergoing an ATO review or audit to assist with maximising their chances of a favourable outcome.

On this page, we explain how taxpayers can effectively manage each stage of an ATO audit.

Before we begin

For taxpayers who are public groups or MNEs the occurrence of a review or audit is often a question of “when” not “if”. This has been particularly so since the inception of the Tax Avoidance Taskforce in 2016 and the Federal Government’s continued support of that taskforce.

In recent years, the ATO has introduced various assurance programs including:

- Top 100: Justified Trust Program for income tax (including transfer pricing) and GST;

- Top 1,000:

- Tax Performance Program;

- Combined Assurance Report Program (CAR) (using justified trust methodology);

- GST Assurance Program; and

- Next Actions Review Program (NAR) (using justified trust methodology).

It is our view that the most important things a taxpayer can do for an audit should not happen during the audit, but well before it. This pre-audit preparation has two elements:

- preparing and keeping contemporaneous documents and records that support and justify the position adopted in a tax return; and

- undertaking a risk assessment before the ATO does.

The 6 stages

We generally consider that an ATO audit can typically be broken down into the six basic stages detailed in the following diagram. We also discuss each stage in further detail below (noting that not all audits will proceed through all six stages and, even if they do, sometimes the stages fall out of that order!)

Understanding the ATO’s risk differentiation framework and compliance activities and having an appropriate tax risk management and governance framework, including contemporaneous documentation should reduce the risk of an adverse audit outcome and also the risk of having to proceed through all six stages.

View our page on corporate tax governance.

Stage 1: Client Risk Review

The ATO will often engage with the taxpayer in routine compliance activity in connection with the Top 100 or Top 1,000 programs that it runs in the public groups space prior to initiating a formal audit.

This stage presents the parties with an opportunity to establish the basic ground rules, such as:

- the issues or matters being examined;

- how requests for information from the ATO are to be handled (informally or via the ATO’s formal access powers);

- the type and extent of records or documents that may be required; and

- the expected timeframe of the audit.

At this stage, it is particularly important for taxpayers to educate the assigned ATO officer as to the time period it is likely to take to respond to information requests. For example, a MNE with a business base and tax function spread across multiple jurisdictions can take considerably longer to provide information than a purely Australian-based operation. The ATO should be made aware of this at an early stage. In some instances, it may also be necessary and appropriate to negotiate approaches which result in a more efficient use of the taxpayer’s resources.

At the conclusion of a Justified Trust review, the ATO will provide the taxpayer with a Tax Assurance Report (TAR). The TAR will typically comment and provide a risk rating for all the matters and issues considered by the ATO as well as an overall risk rating.

Stage 2: ATO Audit & Information Gathering

If the matter progresses to audit (either instead of or after a client risk review), the information gathering will continue. Although the ATO has formal and informal information gathering powers, the relevant officer will typically seek to obtain information informally at first instance. However, the strategy in relation to that provision of information needs to be assessed and managed appropriately.

These information gathering powers are generally subject to one significant carve out: legal professional privilege. Read more about legal professional privilege.

This stage can also be used by taxpayers to gather further information, including interviewing possible third-party witnesses (including expert witnesses) and, in some circumstances, requesting information that the ATO has acquired from other third-party sources. The best plan of attack with respect to the information gathering stage is to be ready before the audit commences.

Taxpayers should be aware that the ATO is able to exchange information with varies overseas tax authorities pursuant to Australia’s tax treaties and the Convention on Mutual Administrative Assistance in Tax Matters, and other instruments.

Going forward, the ATO’s engagement with public groups and MNEs will likely be affected by the OECD's two pillar solution to base erosion and profit shifting (commonly known as BEPS 2.0).

BEPS 2.0 – A taxing time for big tech

21 December 2021

- What is BEPS? What is the OECD/G20 Inclusive Framework?

- What is the BEPS 2.0 project?

- The two pillar solution

- Reception in Australia

- Proposed timeline

Stage 3: Facts/Position Paper

The ATO will generally issue a position paper to the taxpayer. The position paper may be preceded by a facts paper which the ATO seeks comments on.

The position paper, if issued, contains the preliminary views of the ATO. The position paper should, and typically does, set out – from an ATO perspective – the facts, an analysis of the relevant law and the ATO’s position on the tax outcome based on its view of the facts and the law.

The ATO will often provide copies of documents which are referred to and relied on in the position paper, but not necessarily all documents in its possession that it either directly or indirectly relied upon in forming its view. In these circumstances, consideration can be given to lodging a request with the ATO for documents under the Freedom of Information Act 1982 (Cth). However, the freedom of information process is neither an easy nor cost-effective one.

Often, the best time to persuade the ATO to reverse its position is after the ATO has issued its position paper. This might be achieved in one of the following ways:

- The ATO may have made its decision based on incorrect facts. Alternatively, the information gathered by the ATO may be incomplete. It is critical that any factual mistakes are corrected in the taxpayer’s response to a position paper.

- The taxpayer may disagree with the ATO’s interpretation of the law and the application of the law to the facts. Issues of law are typically harder to win at the earlier stages of the dispute because the tax officer’s position is likely to be an ATO-wide position that is the result of the ATO having formed the same view in relation to similar matters.

At times, the ATO will issue a position paper when its review of facts is incomplete. Gaps in facts are often filled by inferences and assumptions (consistent with the ATO case theory), from which ultimate conclusions are drawn. It is always important to identify and rebut these inferences and assumptions. The best evidence will always be objective and contemporaneous evidence, and this may require extensive review of the taxpayer’s email correspondence, electronic files, and historical data. While this can be costly and time intensive, if the matter is to proceed ultimately to litigation, it is a necessary task to be completed.

In our experience, not enough time is spent at this stage. We recommend more focus is made to correcting and clarifying factual mistakes and persuading the ATO that its technical views are incorrect.

Depending on the nature of the matter, the ATO may be required to refer the matter to internal panels (such as the General Anti-Avoidance Rules (GAAR) Panel or the National Fraud or Evasion Advisory Panel). In some circumstances, taxpayers can appear in front of the GAAR Panel and consideration should be given to whether such an appearance will be beneficial to the taxpayer’s case.

Stage 4: (Amended) Assessments

If the taxpayer’s response to a position paper does not convince the ATO, or no response is submitted at all, the ATO will proceed to make the relevant assessments or amended assessments based on the position paper.

The assessments are likely to include interest and possibly penalties, typically ranging from 25% to 75% of the disputed tax (sometimes with reductions or additions), depending on the nature of the behaviour leading to the shortfall. Entities that are significant global entities are subject to increased administrative and other penalties.

For a taxpayer disputing the basis for audit assessments, the next stage of the audit is to lodge objections against the amended tax assessments. Objections are practically the taxpayer’s last chance to persuade the ATO of the correctness of the taxpayer’s position.

Some audits can last for several years and that can sometimes lead to a loss of objectivity by the audit team or a loss of continuity of the audit team, both of which can lead to a misunderstanding of the facts or law in relation to the taxpayer. One advantage of proceeding to the objection stage is that the matter will be reviewed with fresh eyes at the ATO.

Always keep in mind that irrespective of whether a tax assessment is disputed, the ATO has the power to recover the outstanding amounts by whatever means it has at its disposal at any time. This will require management and, in some instances, will not always require full payment prior to the objection being finally determined.

Stage 5: Litigation

If the objection to the assessments is not resolved in the taxpayer’s favour, consideration will need to be given to the commencement of Part IVC proceedings.

Read more about tax litigation.

Stage 6: Settlements & Dispute Resolution

Although we have described settlements and dispute resolution as stage six on this page, in reality, it can occur at all stages of the dispute up to, and even after, the commencement of Part IVC proceedings.

The time at which an appropriate method of dispute resolution should be pursued will depend on the circumstances of each particular case. In our view, a non-litigious method of dispute resolution will only be useful if the audit or dispute is at the stage where there is a realistic prospect of achieving some potential positive outcome, such as resolving the dispute, narrowing the issues in the dispute, or resolving issues hindering progress of the dispute to litigation. Otherwise, the taxpayer may need to consider litigation.

In this regard, there are no specific rules. Taxpayers should consider whether settlements and dispute resolution are appropriate at various stages throughout the audit including:

- before issuing the position paper;

- after issuing the position paper, but before the issuing of amended assessments;

- after lodging the objection, but before the objection decision has been determined; or

- after the objection decision has been determined but before the matter is heard before a court or tribunal.

Depending on the settlement discussions, consideration may need to be given to whether the settlement can withstand scrutiny of the Independent Assurance of Settlements program.

Contact our tax team

ABL is the tax controversy sector leader in end-to-end management of taxation disputes and litigation arising from ATO compliance activities and audits. If you have identified issues or would like assistance in reviewing risks or uncertainties, please contact one of our team members below.